How much is import tax on a car from USA to UK?

When importing a car from the USA to the UK, you'll typically face an import duty of 10% and a VAT of 20%, calculated based on the combined costs of the purchase, shipping, and insurance. The entire delivery process usually spans around 8-10 weeks, contingent on the shipping method and company selected.

Considering importing a car from the USA to the UK? It's essential to be aware of the associated costs. Typically, the UK levies an import duty of 10% and a VAT of 20% on the cumulative costs of the vehicle's purchase, shipping, and insurance. While the process might seem daunting, understanding the breakdown of these charges and the expected delivery timeline, which is usually around 8-10 weeks, can help you plan better. This article delves deeper into the intricacies of the import tax and other related aspects of bringing a car from the USA to the UK.

General Overview of Importing Cars from USA to UK

Importing a car from the USA to the UK involves several steps and considerations. Firstly, one must check if the vehicle meets the specific requirements set by both countries. It's crucial to ensure that your chosen vehicle complies with UK standards for emissions, safety, and other regulatory measures before initiating any purchase or import process.

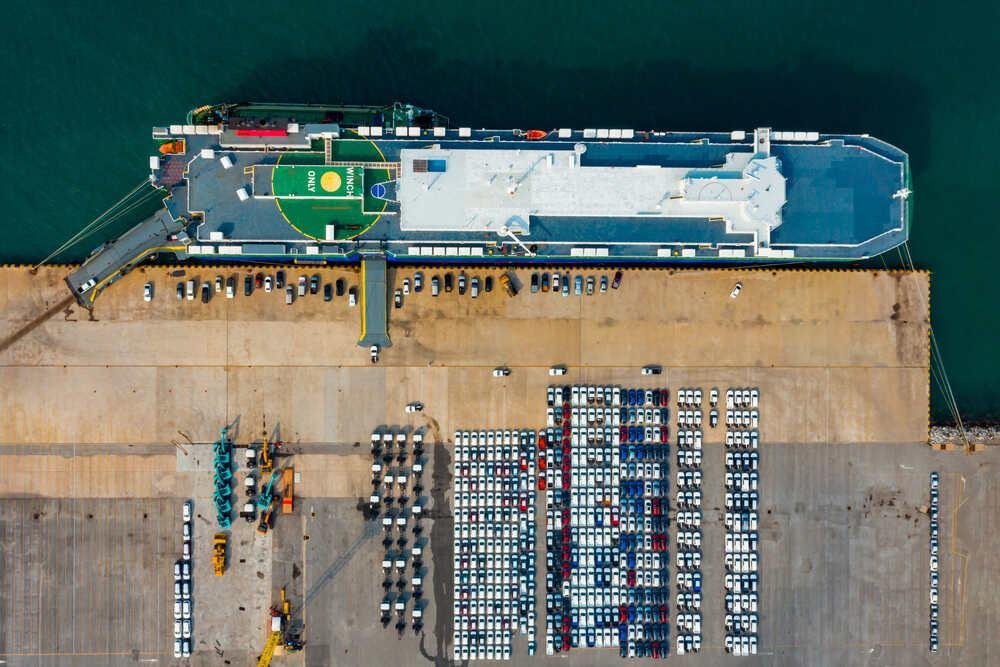

The next step is shipping which can be done either by sea freight or air freight. Sea freight is often less expensive but takes longer time while air freight offers speed at a higher cost. The choice between these two options largely depends on individual preferences and budgetary constraints. Once landed in the UK, customs duties need to be paid based on various factors including the age of the car, and its value among others.

After paying all necessary fees and taxes at customs clearance, it’s essential to register your imported car with the Driver Vehicle Licensing Agency (DVLA). This registration process includes providing documentation about your identity, and proof of ownership of the vehicle along with completed application forms as per DVLA guidelines. After successful completion of this step, you will receive a new registration document making you the legal owner of your imported car in the UK.

Vehicle Specifications and Their Effect on Import Tax

Vehicle specifications play a pivotal role in determining the import tax on vehicles. The UK customs authorities use these details to calculate the amount of duty and VAT that needs to be paid. Factors such as engine size, fuel type, age, and value of the vehicle are taken into account. For instance, cars with larger engines or those running on diesel tend to attract higher taxes due to environmental considerations.

Additionally, modifications made to a vehicle can also influence the import tax levied. If significant alterations have been carried out that increase its market value or change its original category classification, this could result in an increased tax rate. This includes changes like engine swaps or extensive bodywork modifications.

It's worth noting that classic cars over 30 years old may qualify for reduced rates if they meet certain criteria such as being preserved in their original state without substantial changes. However, it is always advisable for individuals importing vehicles from the USA to seek professional advice before proceeding with transactions; understanding how different vehicle specifications impact taxation can help avoid unexpected costs upon arrival in the UK.

Comments

Post a Comment